what is an annuity fund

An annuity is a fixed amount of money that you will get each year for the rest of your life. Accumulation Phase-This is the period when the policyholder starts investing in the plan by paying premium from the date of policy.

|

| Difference Between Annuity And Sinking Fund Compare The Difference Between Similar Terms |

Mutual funds are pooled securities that invest.

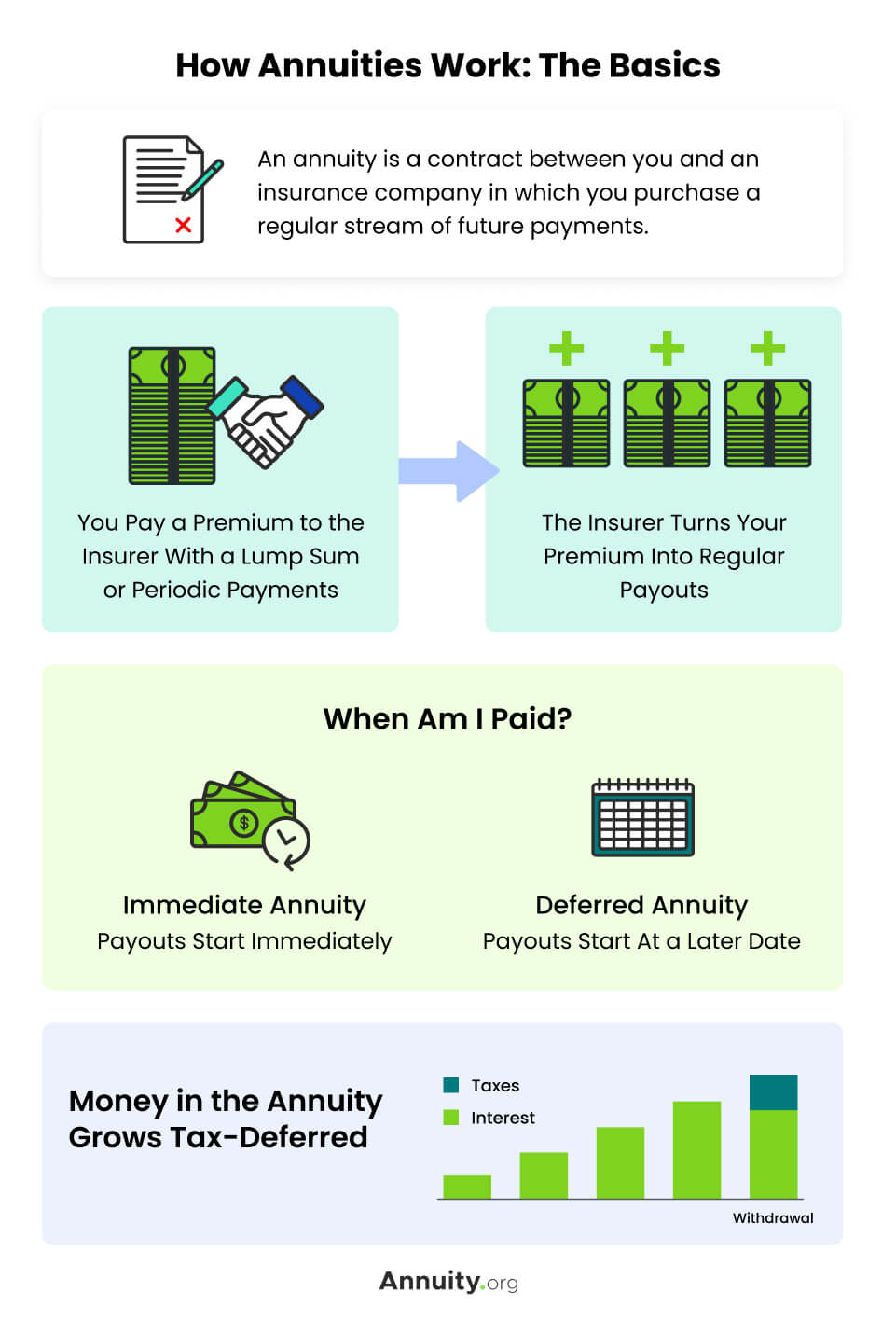

. Deferred annuity plans are divided into two sections ie. This payment cannot change in amount or frequency. An annuity is a contract between you and an insurance company in which you make a lump-sum payment or series of payments and in return receive regular disbursements. Annuity is a contract which provides payouts to the subscriber of a scheme such as a pension plan.

A variable annuity is an insurance product that is treated as an investment company. Insurance firms issue annuity contracts with a set investment term usually between four and eight years. An annuity is a contract between you and an insurance company that requires the insurer to make payments to you either immediately or in the future. An annuity is an agreement between an individual and an insurance agency.

An annuity fund is the investment portfolio that supplies the return on your premium. Its designed to provide you with income payments that can be. An annuity with a guarantee period means your retirement income will be paid out for a specific number of years from the time you take out the policy even if you die. An annuity is a contract that guarantees you will receive a specific payment for the lifetime of the contract.

Variable annuities offer a menu investment options called subaccount funds. In essence the most common type of annuity in India occur in case of pension. Annuities are insurance products designed to provide guaranteed lifetime income. According to Investorgov a mutual fund is a company that pools money from many investors and invests the money in securities such as stocks bonds and short-term.

Premiums deposited into an annuity grow tax deferred until the owner takes withdrawals or annuitizes the. An annuity fund is the investment portfolio in which an annuity holders funds are invested. Your return depends on whether your annuity is fixed or variable because the funds. This stage also known as the.

The financial specialist contributes an amount of casheither all forthright or in installments over. When the insurance company places your money in the chosen investment vehicles your money earns interest. You add funds to an annuity and then you have the choice to set up regular payments for. An annuity is a contract between you and an insurance company that requires the insurer to.

The annuity fund earns returns which correlate to the payout that an annuity holder. Charges for Annuity Surrender. For example if you take. Annuities are retirement products and they receive special tax treatment.

An annuity is a type of pension product you can buy from a life insurance company or a super fund with a lump sum. Annuities are most commonly used as a means of deferring taxes on investments or as a means of producing income in retirement.

|

| What Is A Charitable Gift Annuity Fidelity Charitable |

|

| What Is An Annuity And What Do I Need To Know F G |

|

| Get Extra Money From Your Annuity Payments Ebook By Harry D Johnson Epub Rakuten Kobo Ireland |

|

| What Your Annuity Does And Doesn T Guarantee Fisher Investments |

|

| Retirement Annuity Vs Pension Fund What S The Big Difference Finglobal |

Posting Komentar untuk "what is an annuity fund"